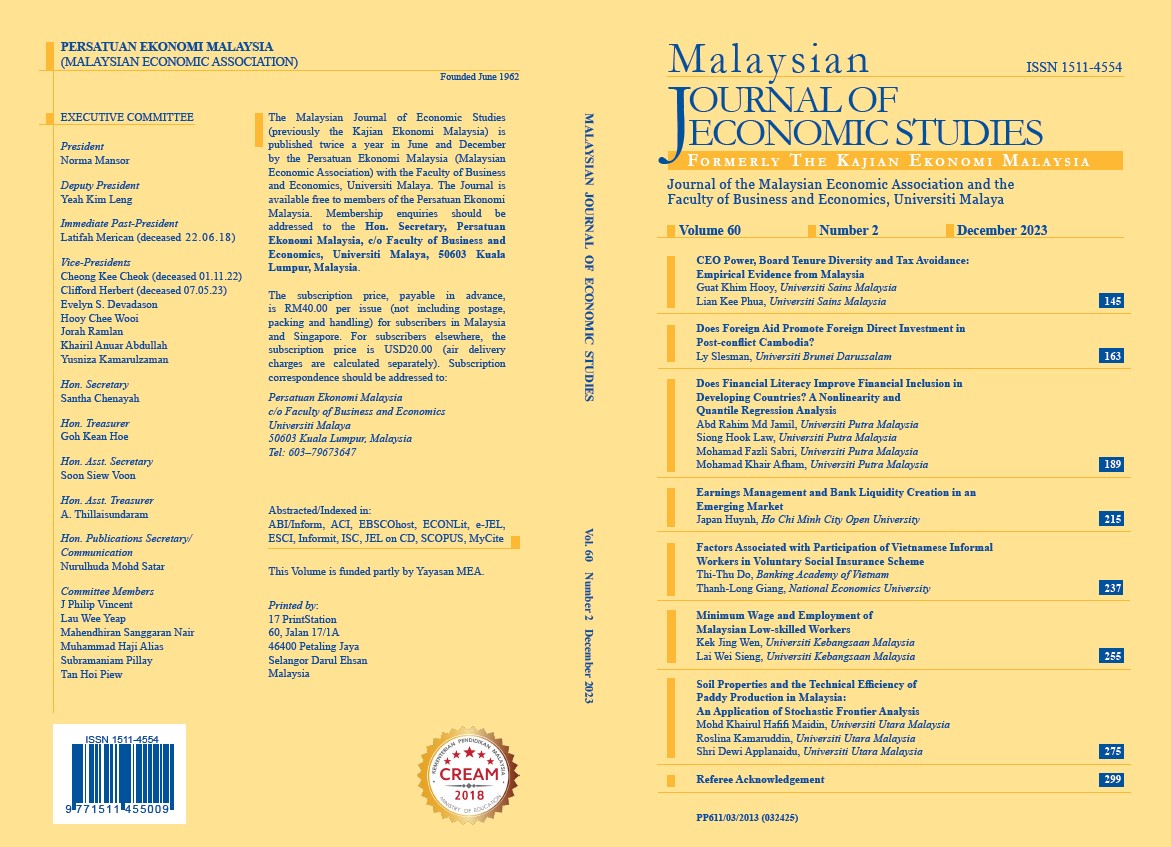

CEO Power, Board Tenure Diversity and Tax Avoidance: Empirical Evidence from Malaysia

DOI:

https://doi.org/10.22452/MJES.vol60no2.1Keywords:

Tax avoidance, effective tax rate, CEO power, board tenure diversity, emerging marketAbstract

This study aims to assess the relationship between CEO power and tax avoidance and the moderating effects of board tenure diversity on this connection. Based on firms listed on the Main Market of Bursa Malaysia from 2009 to 2019, the study finds that CEOs with more dimensions of power are more likely to engage in tax avoidance activities. Further tests reveal that this positive association is strengthened by board tenure diversity, suggesting that a more diverse board tenure increases CEO competence in tax avoidance.

Downloads

Download data is not yet available.